Nebius' Token Factory: A Real Threat or Just Another Cloud Player?

Nebius, fresh off its split from Yandex, is making waves with its new "Token Factory," an AI cloud platform aimed squarely at the big boys: AWS, Azure, and GCP. The pitch? Run leading open-source models at scale with enterprise-grade reliability. They're talking DeepSeek, GPT-OSS, Llama, Nemotron, Qwen – the whole open-source shebang. And, critically, they're boasting sub-second latency and 99.9% uptime, even with hundreds of millions of requests per minute. Ambitious claims, to say the least.

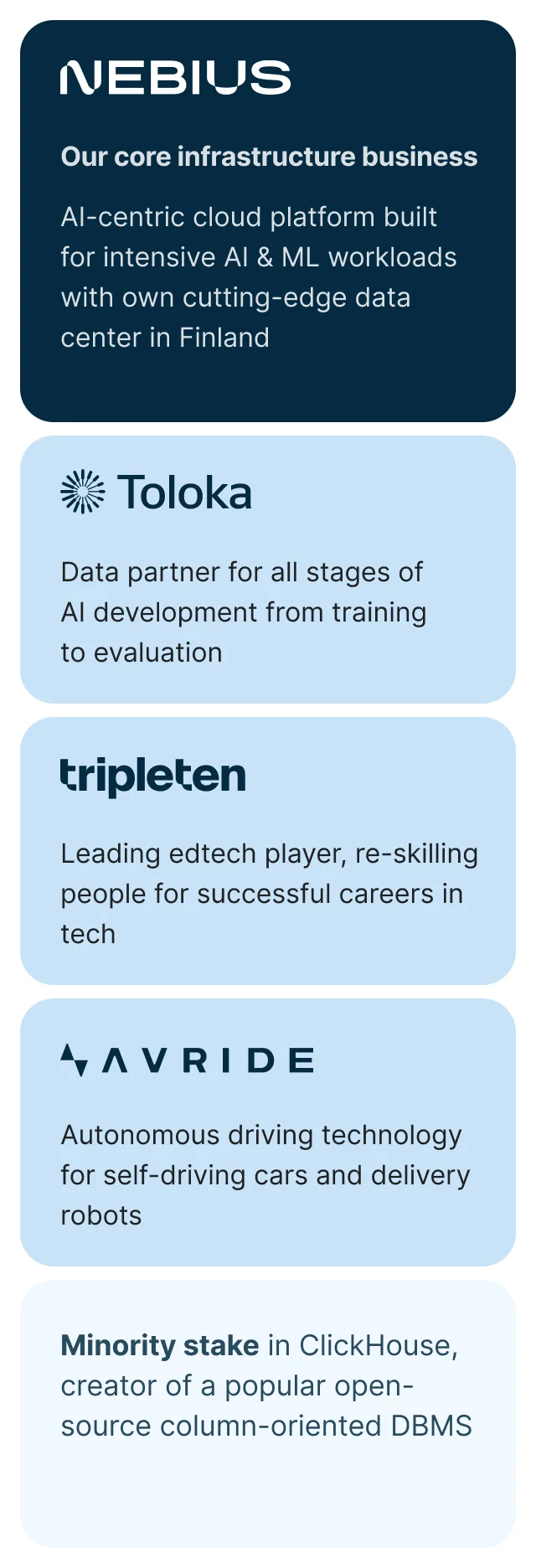

So, what's the real story here? Nebius is positioning itself as more than just another "utility company," as CEO Roman Chernin puts it. They want to offer more than just raw compute. The lure is higher profit margins from software services layered on top of cloud infrastructure. This isn't a new idea; it's the classic value-add play. But the question is, can they actually deliver at the scale they're promising?

The Profit Margin Mirage

Chernin claims the firm is less interested in boosting margins and more interested in attracting customers with a wider array of products. But let's be blunt: these two goals are inextricably linked. Higher margins are the incentive to offer more complex services. Nebius' ability to attract customers depends on offering something demonstrably better (faster, cheaper, more reliable) than the established players. And that "better" translates directly into a defensible margin.

The earnings preview from earlier in the week highlights the "Vineland Ramp" as a key catalyst for full-year targets. (Vineland, presumably, being a specific datacenter or project.) What isn't clear is the unit economics of this ramp. How much is Nebius spending to acquire each new customer? What's the average revenue per user (ARPU)? Without these figures, the "wider array of products" narrative remains just that: a narrative. More information on the Vineland Ramp can be found in Nebius Q3 Earnings Preview: Vineland Ramp Is The Key Catalyst For Full-Year Targets (NASDAQ:NBIS).

The Open-Source Advantage?

Nebius is betting big on open-source. That's a smart move, theoretically. Open-source models offer flexibility and avoid vendor lock-in, appealing to enterprises wary of being beholden to a single AI provider. But here's the rub: open-source doesn't automatically equate to cheaper or easier. Deploying and optimizing these models at scale requires significant in-house expertise.

Token Factory supports over 60 open-source models and offers customers the option to host their own models. I've looked at dozens of these platforms, and this particular boast always raises an eyebrow. Supporting 60 models adequately—meaning providing optimized runtimes, security patches, and ongoing maintenance—is a massive undertaking. Are they spreading themselves too thin? Are they truly experts in all 60, or are they just checking boxes?

The comparison to Fireworks and Baseten is also telling. These "new-age startups" are agile and laser-focused. Nebius, while newer than the hyperscalers, still carries the legacy of being a Yandex spin-off. Can they truly compete with the nimbleness of a startup while simultaneously offering the reliability of a major cloud provider? That's a tough needle to thread.

Show Me the Uptime Numbers

Nebius is promising 99.9% uptime, which translates to roughly 43 minutes of downtime per month. That's the industry standard, but the devil is always in the details. What's their definition of "uptime"? Does it include planned maintenance? How do they handle regional outages? And, crucially, what are the penalties for failing to meet that 99.9% guarantee? Without transparency on these points, the uptime figure is just marketing fluff.

Ultimately, Nebius' success hinges on execution. They've identified a clear market opportunity: providing a flexible, open-source alternative to the hyperscalers. But they need to back up their ambitious claims with hard data. Show me the ARPU, the customer acquisition costs, the detailed uptime reports. Until then, Token Factory remains an interesting concept with a lot to prove.